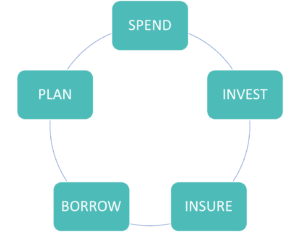

The behaviour of an individual today in terms of spending, investing, risk management, borrowing, and planning greatly impacts their financial health.

- Spend – How much an individual earns (income) is usually not controllable, at least in the short term. Therefore, one must learn the art of managing expenses within the available income. There are two kinds of expenses that are incurred by individuals – the non-discretionary (or essential) expenses and the discretionary (or non-essential) expenses. A financially healthy individual would spend the income partly on the essential items and to reduce or minimize the discretionary expenses, to achieve a disposable surplus, called Savings. The 50-30-20 Rule is one of the ways to create a disposable surplus. According to this rule, one should spend about 50% of one’s earning for essential items, spend not more than 30% on discretionary items and set aside at least 20% as Savings. The financial technique used to practice financial discipline in one’s spending patterns is called budgeting. A budget, classified into expense categories, enables the individual to analyze expense patterns and make necessary adjustments.

- Invest – Achieving a disposable surplus (Saving) is essential, but it is equally important to utilize it productively, to generate returns. The purpose of the Savings is not saving by itself, it is rather growing one’s wealth or creating assets, which will benefit the individual in future. The investment avenue (bank deposits, mutual funds, equity, etc) can be decided based on the risk-taking capacity of the individual, amongst other factors. An important consideration is the decrease in purchasing power of money, due to inflation. Therefore, the returns on investment must be enough to beat the rate of inflation.

- Insure – While one is creating assets and generating income, it becomes very important to protect these assets and incomes from the risk of loss. Insurance is a method of transferring the risk of loss (of something valuable, like one’s income or asset) to a third party, the insurer, for a small consideration, called the premium. It is important to consider Life Insurance (for the earning member of a family), Health Insurance (for all family members) and Non-Life Insurance (like car insurance, home insurance, etc) for the assets created by the individual.

- Borrow – There are times when the savings are not adequate to fund the purchase of an asset (like a house or a car) or to incur an expenditure (like a vacation or marriage). In such circumstances, it is considered normal to use borrowed funds to do the same. However, borrowing must be done thoughtfully and only when necessary. In layperson terms, borrowed money should be used only when the benefit of purchasing an asset (or the expenditure) is perceived as more than the cost of borrowing (that is, the interest). Borrowing imposes a future expense of the essential category on the individual, which eats into the saving component. Excessive borrowing (particularly when it is not paid off fully when due) would reduce the credit score of the individual. A reduced credit score may prevent the individual from getting credit in future when he may really need it for some essential expenditure.

- Plan – Every individual aspires for a self-reliant future, where they will be able to fulfil their needs and wants, comfortably. Making S.M.A.R.T Goals for the very-short, short, medium, and long-term future is an effective way to achieve financial well-being. Based on the timeline of the goal and the risk that can be taken, suitable investment avenues are decided upon. For example, a moderate risk fund may be created for medium-term goals (like education of children) and a high-risk investment may be made for long-term goals, like retirement.

Once an individual has successfully scaled the 5 pillars of financial health, they simply have to review the progress and sustain the momentum to achieve financial wellness.

This can all seem overwhelming at first, but if we work through it one by one and at a pace that suits us, it is achievable.

True. The idea is to start and then continue on the path. Too often we don’t even consider starting a process because the whole thing seems so daunting.